我們的服務

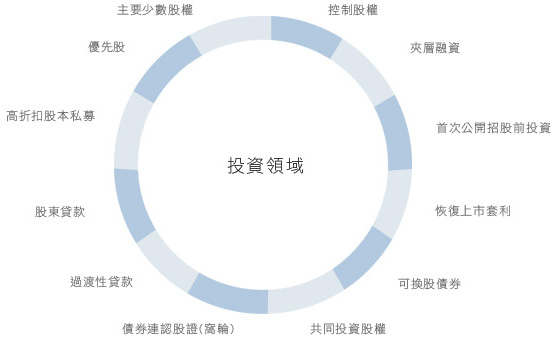

另類投資

Isola Capital has a broad global network with access to proprietary direct investment deal flows. It is not unusual their direct investment team evaluate 80 deals per quarter. As Isola Capital's strategic partner in the Greater China region, these exclusive investment opportunities are offered to our clients and partners on a discrete basis.

We believe Isola Capital's global network and deal sourcing capability to pounce on unique proprietary investments that is not available through traditional avenues. Their investment philosophy hark back to its heritage and traditions that deals are bought to the Investor Round Table which gone through set of rigorous due diligence procedure. As deals usually co-invest with other members of the Investor Roundtable who are mostly Isola Capital's shareholders or long-term clients. The deals are typically structured in a way that will generate cash returns with appropriate downside protection.