Services

Asset Management

Our Investment Approach

Investment is an intricate process that requires time and knowledge to identify superior investment opportunities. To create wealth for the long-term, it is critical to be disciplined and employ sound investment strategies.

Investment philosophy

Our investment philosophy is based on helping you grow and protect your wealth in a way that matches your long-term investment objectives and distinct financial personality. Investment research of various private banking specialists, independent external research houses as well as our in-house team provides a basis for investment decisions. Further analysis is done through careful examination on economic parameters with high conviction. Finally, emphasis on capital protection is always the top priority in spite of various risk appetite profiles of different clients.

Active management

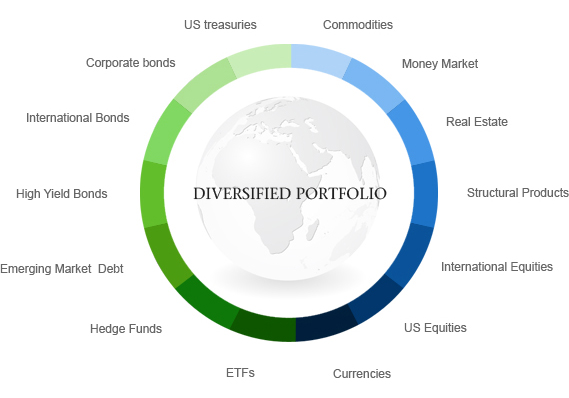

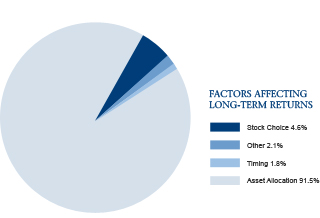

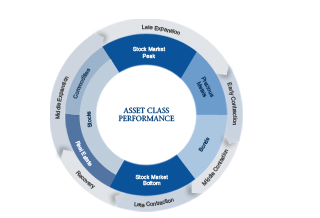

Asset allocation has a decisive effect on expected returns. Our multi-asset class platform provides a gateway to our clients accessing a broad investment universe. We endeavor to identify the strategic asset allocation that consistent with investor's long term return expectation and risk profile at the time the investment policy statement is established.

The tailor made portfolios will be invested on genuine gain opportunity, independent of any structured investment style. With the support of our in-house research team and our associated global banking product specialists, your investment managers adopt an active style through tactical reallocation to rebalance asset class during the changes of market conditions to achieve capital preservation and optimize portfolio return potential during different economic cycles.

Click to enlarge

Click to enlarge

Click to enlarge

Click to enlarge